Present value of lease payments

Commercial Leasing The lease rate is primarily applicable for two. Since the up-front cash payment is less than the present value of the 36 monthly lease payments ABC should pay cash for the machinery.

Lease Accounting Operating And Finance Leases And Valuation

Insurance value This is the appraised value by an insurance company used to set the price of insurance as part of its risk assessment.

. The formula of PV PV P 1 1i-n i Given. Example of Lease Rate Calculation. The present value of the unguaranteed amount of the underlying assets residual value at the end of the lease term.

The present value of lease payments not yet received. The ground rent provides an income for the landowner. As a legal term ground rent specifically refers to regular payments made by a holder of a leasehold property to the freeholder or a superior leaseholder as required under a leaseIn this sense a ground rent is created when a freehold piece of land is sold on a long lease or leases.

Download our Present Value Calculator to determine the present value of your lease payments under ASC 842 IFRS 16 and GASB 87. GAAP leases are finance leases if any of four conditions are met. Implicit rate of interest i.

A residual value guarantee is included at lease inception in the calculation of the minimum lease payments and is paid at the end of the lease term. It also creates a corresponding Lease Liability based on the same calculation. The present value of the guaranteed amount of the underlying assets residual value at the end of the lease term.

In a leveraged lease the lending company holds the title to the leased. At the commencement of a lease IFRS 16 requires a lessee to measure the lease liability at the present value of the lease payments that are not paid at that date. How to Calculate a Lease Rate.

Present value test. You are free to use this image on your website templates. This liability includes both fixed payments including in-substance fixed payments and variable lease payments that depend on an index or rate and represents the starting point for.

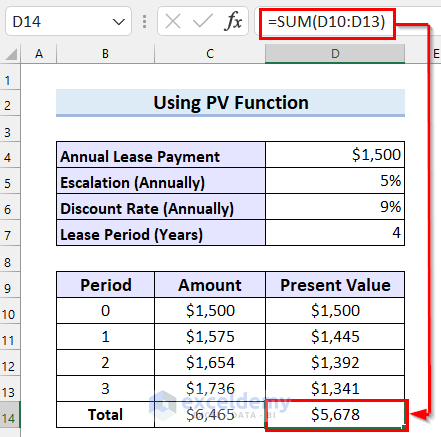

In the calculation we convert the annual 9 rate to a monthly rate of 34 which is calculated as the 9 annual rate divided by 12 months. It is the liquidation value of a company in bankruptcy. The fourth condition requires capitalization if the present value of minimum lease payments MLP is greater than 90 of.

All of the assets and liabilities that. A lease agreement that is partially financed by the lessor through a third-party financial institution. At commencement of the lease term finance leases should be recorded as an asset and a liability at the lower of the fair value of the asset and the present value of the minimum lease payments discounted at the interest rate implicit in the lease if practicable or else at the entitys incremental borrowing rate IAS 1720.

Book value Book value is the worth of the mineral interests after the project has paid off all its debts assets liabilities. Lets say you pay 1000 a month in rent. Under the new lease accounting standards lessees are required to calculate the present value of any future lease payments to.

The present value of lease rentals is equal to or greater than the assets fair market value. The guaranteed residual value GRV is the residual value of a leased asset that is guaranteed by the lessee or by a financially capable third party not related to the lessor and included in the. Plus initial direct costs and prepaid lease payments.

Disadvantages of the Present Value of an Ordinary Annuity Formula. Minus lessor incentives accrued rent and ASC 420 liability at transition date. Fixed at 20 per year.

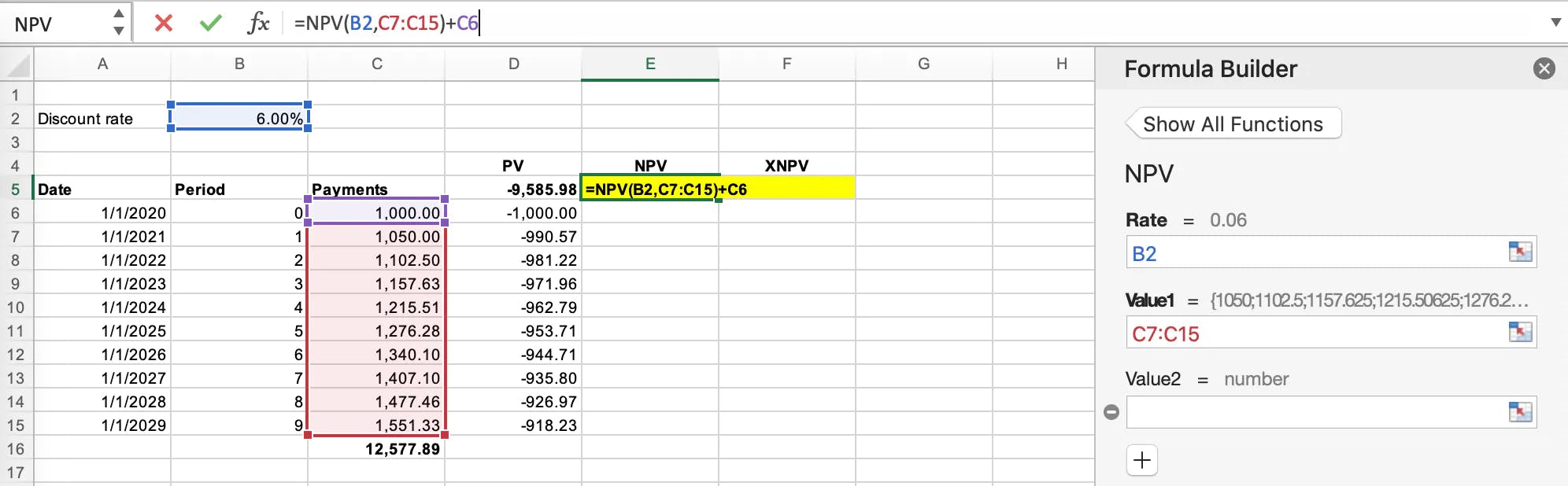

In economics ground rent is a form of. Recognize profit or loss. Present value commonly referred to as PV is the calculation of what a future sum of money or stream of cash flows is worth today given a specified rate of return over a specified period of time.

Initially the company creates a Lease Asset based on the Present Value of the lease payments over the next 10 years. For example you could use this formula to calculate the present value of your future rent payments as specified in your lease. Is the present value of lease payments plus RVG residual value guaranteed by the lessee.

Annual lease rents P 500000 and. Calculation of present value PV of min finance lease payments. Calculate Accurately for Compliance To comply with the new lease accounting standards youll need to calculate the present value of most of your leases.

Accounting for Variable Lease Payments. Present value of lease payments explained. Taking the impact of the depreciated value the monthly lease payment Monthly Lease Payment Lease payments are the payments where the lessee under the lease agreement has to pay monthly fixed rental for using the asset to the lessor.

5 this is close to the rate the company would pay on secured debt. Over the life of the lease the ROU is amortized linearly. The lessor recognizes any.

How To Calculate The Discount Rate Implicit In The Lease

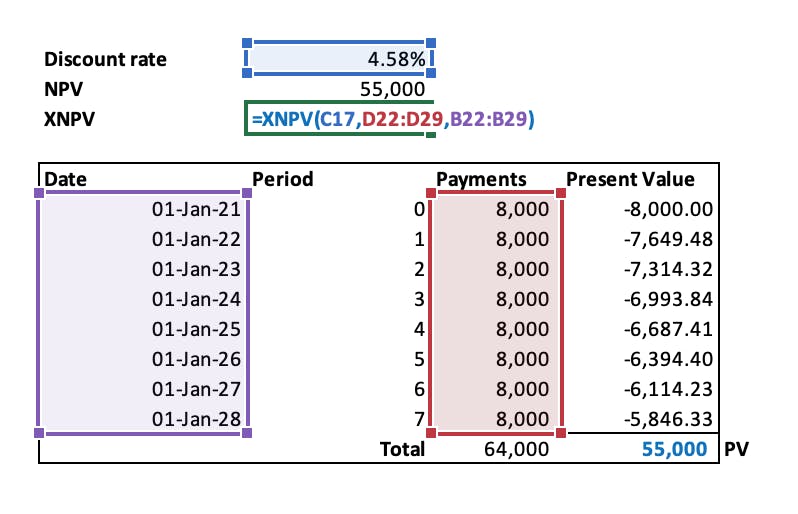

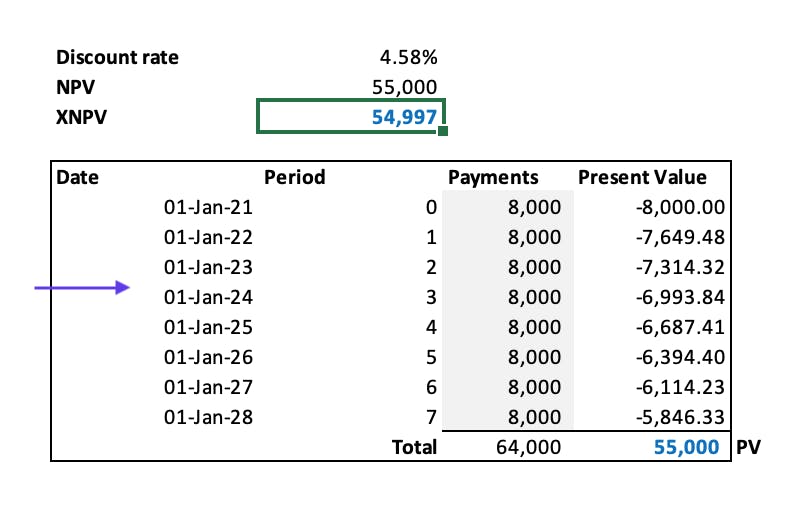

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate The Present Value Of Lease Payments In Excel

Compute The Present Value Of Minimum Future Lease Payments Youtube

/Clipboard01-618bfd11c29a4e2dbd2a50ea127f34d1.jpg)

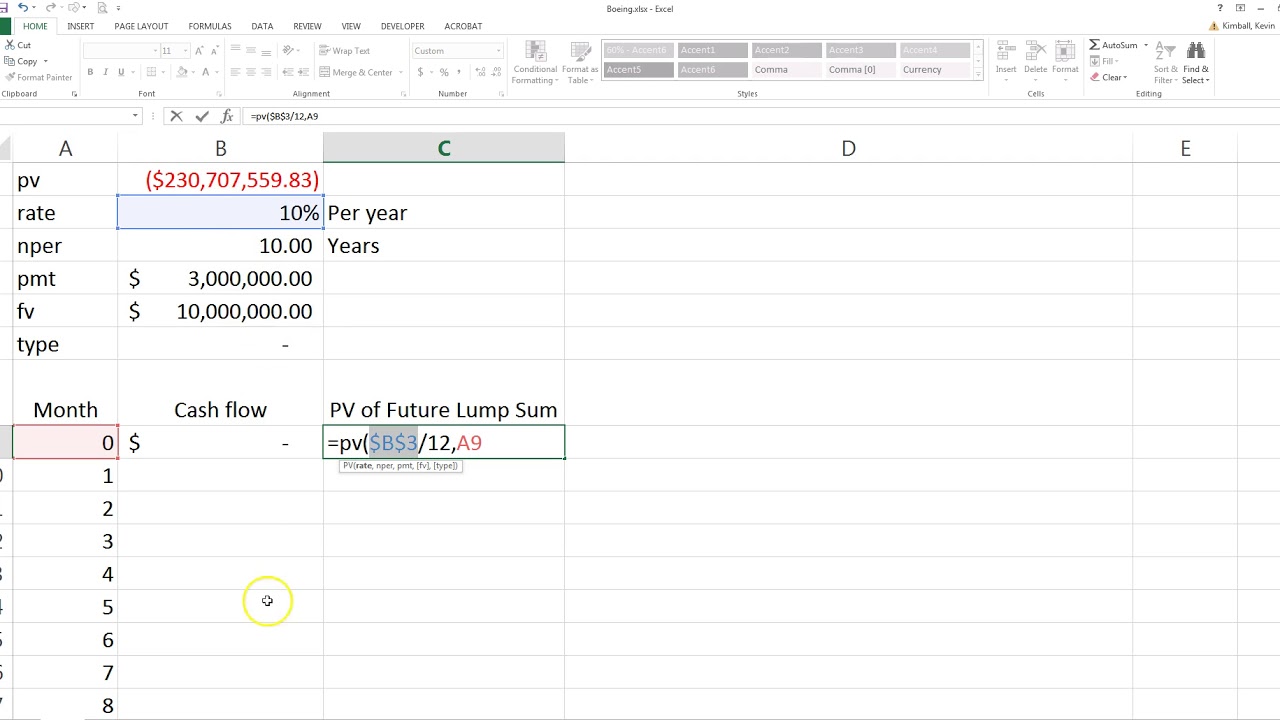

Present Value Excel How To Calculate Pv In Excel

A Refresher On Accounting For Leases The Cpa Journal

Calculate Lease Payments Tvmcalcs Com

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

How To Calculate A Lease Payment In Excel 4 Easy Ways

Compute The Present Value Of Minimum Future Lease Payments Youtube

How To Calculate The Present Value Of Future Lease Payments

How To Calculate A Lease Payment Double Entry Bookkeeping

Calculating Present Value Accountingcoach

How To Calculate The Discount Rate Implicit In The Lease

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate The Present Value Of Future Lease Payments